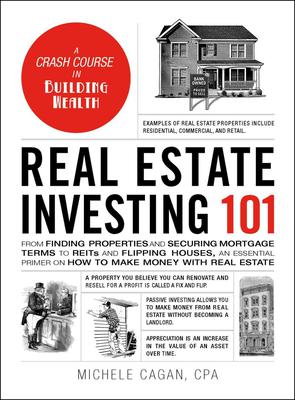

A comprehensive, accessible, and easy-to-understand guide to everything you need to know about real estate investing.

Real estate investing is a great way to build a business or make money on the side—and you don’t have to be a full-time landlord to do it. Real Estate Investing 101 walks you through everything you need to know, from raising capital to uncovering new opportunities. You’ll learn the difference between purchasing traditional property and investing in funds such as REITs and interval funds—plus new types of realty investment, like crowd-funded real estate, the senior housing boom, eco-housing, and blockchain technology. With the expert advice in Real Estate Investing 101 to guide you, you can invest with confidence and generate profits.

18’900

Дууссан(Дууссан)

The founder and CEO of AppSumo.com, Noah Kagan, knows how to launch a seven-figure business in a single weekend—and he’s done it seven times. Million Dollar Weekend will show you how.

Now is the best time in history for entrepreneurship. More than ever, the world needs new businesses and it’s cheaper than ever to create them.

And, let’s be most day jobs suck. People spend too much time doing too much work for too little money—and they know it. They want out.

But, if the barriers to starting a business are getting lower and lower, why is it SO HARD TO DO for SO MANY PEOPLE? Why are there so many wantrepreneurs playing at business on social media and so few entrepreneurs actually running them?

Ask

All those Frequent Excuses are solvable. The plan is simple—so simple it can be completed in a single weekend, but so powerful that Kagan has used to build seven businesses now worth more than $1

By Monday, you’ll have a market-tested, scalable business idea and you’ll be a entrepreneur on the path to seven figures. Million Dollar Weekend is the path to creating your dream life and attaining financial freedom. LFG.

19’900

Дууссан#1 New York Times, Wall Street Journal, and USA Today Bestseller!

Secrets of the Millionaire Mind reveals the missing link between wanting success and achieving it!

Have you ever wondered why some people seem to get rich easily, while others are destined for a life of financial struggle? Is the difference found in their education, intelligence, skills, timing, work habits, contacts, luck, or their choice of jobs, businesses, or investments?

The shocking answer is: None of the above!

In his groundbreaking Secrets of the Millionaire Mind, T. Harv Eker states: "Give me five minutes, and I can predict your financial future for the rest of your life!" Eker does this by identifying your "money and success blueprint." We all have a personal money blueprint ingrained in our subconscious minds, and it is this blueprint, more than anything, that will determine our financial lives. You can know everything about marketing, sales, negotiations, stocks, real estate, and the world of finance, but if your money blueprint is not set for a high level of success, you will never have a lot of money—and if somehow you do, you will most likely lose it! The good news is that now you can actually reset your money blueprint to create natural and automatic success.

Secrets of the Millionaire Mind is two books in one. Part I explains how your money blueprint works. Through Eker's rare combination of street smarts, humor, and heart, you will learn how your childhood influences have shaped your financial destiny. You will also learn how to identify your own money blueprint and "revise" it to not only create success but, more important, to keep and continually grow it.

In Part II you will be introduced to seventeen "Wealth Files," which describe exactly how rich people think and act differently than most poor and middle-class people. Each Wealth File includes action steps for you to practice in the real world in order to dramatically increase your income and accumulate wealth.

If you are not doing as well financially as you would like, you will have to change your money blueprint. Unfortunately your current money blueprint will tend to stay with you for the rest of your life, unless you identify and revise it, and that's exactly what you will do with the help of this extraordinary book. According to T. Harv Eker, it's simple. If you think like rich people think and do what rich people do, chances are you'll get rich too!

18’900

СагслахAll you need to know about buying and selling stocks! Too often, textbooks turn the noteworthy details of investing into tedious discourse that would put even a hedge fund manager to sleep. Stock Market 101 cuts out the boring explanations of basic investing, and instead provides hands-on lessons that keep you engaged as you learn how to build a portfolio and expand your wealth.

From bull markets to bear markets to sideways markets, this primer is packed with hundreds of entertaining tidbits and concepts that you won't be able to get anywhere else. So whether you're looking to master the major principles of stock market investing or just want to learn more about how the market shifts over time, Stock Market 101 has all the answers--even the ones you didn't know you were looking for.

21’900

СагслахA crash course in managing personal wealth and building a profitable portfolio—from stocks and bonds to IPOs and more!

Too often, textbooks turn the noteworthy details of investing into tedious discourse that would put even Warren Buffett to sleep. Investing 101 cuts out the boring explanations, and instead provides a hands-on lesson that keeps you engaged as you learn how to build a portfolio and expand your savings. From value investing to short selling to risk tolerance, this primer is packed with hundreds of entertaining tidbits and concepts that you won't be able to get anywhere else.

So whether you're looking to master the major principles of investing, or just want to learn more about stocks and bonds, Investing 101 has all the answers--even the ones you didn't know you were looking for.

20’900

СагслахGetting an MBA is an expensive choice-one almost impossible to justify regardless of the state of the economy. Even the elite schools like Harvard and Wharton offer outdated, assembly-line programs that teach you more about PowerPoint presentations and unnecessary financial models than what it takes to run a real business. You can get better results (and save hundreds of thousands of dollars) by skipping business school altogether.

Josh Kaufman founded PersonalMBA.com as an alternative to the business school boondoggle. His blog has introduced hundreds of thousands of readers to the best business books and most powerful business concepts of all time. Now, he shares the essentials of entrepreneurship, marketing, sales, negotiation, operations, productivity, systems design, and much more, in one comprehensive volume. The Personal MBA distills the most valuable business lessons into simple, memorable mental models that can be applied to real-world challenges.

The Personal MBA explains concepts such as:

- The Iron Law of the Market: Why every business is limited by the size and quality of the market it attempts to serve-and how to find large, hungry markets.

- The 12 Forms of Value: Products and services are only two of the twelve ways you can create value for your customers.

- The Pricing Uncertainty Principle: All prices are malleable. Raising your prices is the best way to dramatically increase profitability - if you know how to support the price you're asking.

- 4 Methods to Increase Revenue: There are only four ways a business can bring in more money. Do you know what they are?

True leaders aren't made by business schools - they make themselves, seeking out the knowledge, skills, and experience they need to succeed. Read this book and you will learn the principles it takes most business professionals a lifetime of trial and error to master.

24’900

СагслахThe greatest investment advisor of the twentieth century, Benjamin Graham taught and inspired people worldwide. Graham's philosophy of "value investing" -- which shields investors from substantial error and teaches them to develop long-term strategies -- has made The Intelligent Investor the stock market bible ever since its original publication in 1949.

Over the years, market developments have proven the wisdom of Graham's strategies. While preserving the integrity of Graham's original text, this revised edition includes updated commentary by noted financial journalist Jason Zweig, whose perspective incorporates the realities of today's market, draws parallels between Graham's examples and today's financial headlines, and gives readers a more thorough understanding of how to apply Graham's principles.

Vital and indispensable, this HarperBusiness Essentials edition of The Intelligent Investor is the most important book you will ever read on how to reach your financial goals.

17’900

СагслахDoing well with money isn't necessarily about what you know. It's about how you behave. And behavior is hard to teach, even to really smart people. Money--investing, personal finance, and business decisions--is typically taught as a math-based field, where data and formulas tell us exactly what to do. But in the real world people don't make financial decisions on a spreadsheet.

They make them at the dinner table, or in a meeting room, where personal history, your own unique view of the world, ego, pride, marketing, and odd incentives are scrambled together. In The Psychology of Money, award-winning author Morgan Housel shares 19 short stories exploring the strange ways people think about money and teaches you how to make better sense of one of life's most important topics.

17’900

СагслахThe Tao of Warren Buffett, co-written by Mary Buffett and David Clark, is a must-read book for anyone interested in investing or seeking a life philosophy for success. Drawing on the teachings of the ancient Chinese philosopher Lao-tzu and Warren Buffett's wisdom, the book offers a collection of memorable sayings that reveal the investment strategies and life philosophies that made Warren Buffett the world's most successful investor and the world's richest man.

The authors provide insights and strategies that can benefit everyone, from serious investors to individuals looking for a guiding principle for success. With its straightforward and easy-to-understand language, The Tao of Warren Buffett is an indispensable guide for those looking to learn the secrets to success from one of the most respected and successful investors of all time.

Think and Grow Rich is a guide to success by Napoleon Hill, which was first published in 1937 following the Great Depression. It was immediately welcomed as an antidote to hard times and remained a bestseller for decades. Many people still find its philosophy of positive thinking and its specific steps for achieving wealth both relevant and life-changing. Hill contends that our thoughts become our reality, and offers a plan and principles for transforming thoughts into riches, including visualization, affirmation, creating a Master Mind group, defining a goal, and planning.

20’900

СагслахThink and Grow Rich is a guide to success by Napoleon Hill, which was first published in 1937 following the Great Depression. It was immediately welcomed as an antidote to hard times and remained a bestseller for decades. Many people still find its philosophy of positive thinking and its specific steps for achieving wealth both relevant and life-changing.

Hill contends that our thoughts become our reality, and offers a plan and principles for transforming thoughts into riches, including visualization, affirmation, creating a Master Mind group, defining a goal, and planning.

17’900

СагслахOne of the first books to address the psychological nature of how successful traders think ~ The Disciplined Trader™is now an industry classic. In this ground-breaking work published in 1990 ~ Douglas examines the causes as to why most traders cannot raise and keep their equity on a consistent basis ~ and brings the reader to practical and unique conclusions as to how to go about changing any limiting mindset.

The trader is taken through a step-by-step process to breakthrough those queries ~ and begin to understand that their very thoughts may be limiting their ability to accumulate and succeed at trading.

20’900

СагслахDouglas uncovers the underlying reasons for lack of consistency and helps traders overcome the ingrained mental habits that cost them money. He takes on the myths of the market and exposes them one by one teaching traders to look beyond random outcomes, to understand the true realities of risk, and to be comfortable with the "probabilities" of market movement that governs all market speculation.

18’900

СагслахAs seen on the new NETFLIX series! The groundbreaking NEW YORK TIMES and WALL STREET JOURNAL BESTSELLER that taught a generation how to earn more, save more, and live a rich life—now in a revised 2nd edition.

Buy as many lattes as you want. Choose the right accounts and investments so your money grows for you—automatically. Best of all, spend guilt-free on the things you love.

Personal finance expert Ramit Sethi has been called a “wealth wizard” by Forbes and the “new guru on the block” by Fortune . Now he’s updated and expanded his modern money classic for a new age, delivering a simple, powerful, no-BS 6-week program that just works.

I Will Teach You to Be Rich will show

• How to crush your debt and student loans faster than you thought possible

• How to set up no-fee, high-interest bank accounts that won’t gouge you for every penny

• How Ramit automates his finances so his money goes exactly where he wants it to—and how you can do it too

• How to talk your way out of late fees (with word-for-word scripts)

• How to save hundreds or even thousands per month (and still buy what you love)

• A set-it-and-forget-it investment strategy that’s dead simple and beats financial advisors at their own game

• How to handle buying a car or a house, paying for a wedding, having kids, and other big expenses—stress free

• The exact words to use to negotiate a big raise at work

Plus, this 10th anniversary edition features over 80 new pages,

• New tools

• New insights on money and psychology

• Amazing stories of how previous readers used the book to create their rich lives

Master your money—and then get on with your life.

22’900

СагслахWhich is more dangerous, a gun or a swimming pool? What do schoolteachers and sumo wrestlers have in common? Why do drug dealers still live with their moms? How much do parents really matter? What kind of impact did Roe v. Wade have on violent crime? Freakonomics will literally redefine the way we view the modern world.

These may not sound like typical questions for an economist to ask. But Steven D. Levitt is not a typical economist. He is a much heralded scholar who studies the stuff and riddles of everyday life -- from cheating and crime to sports and child rearing -- and whose conclusions regularly turn the conventional wisdom on its head. He usually begins with a mountain of data and a simple, unasked question. Some of these questions concern life-and-death issues; others have an admittedly freakish quality. Thus the new field of study contained in this book: freakonomics.

Through forceful storytelling and wry insight, Levitt and co-author Stephen J. Dubner show that economics is, at root, the study of incentives -- how people get what they want, or need, especially when other people want or need the same thing. In Freakonomics, they set out to explore the hidden side of ... well, everything. The inner workings of a crack gang. The truth about real-estate agents. The myths of campaign finance. The telltale marks of a cheating schoolteacher. The secrets of the Ku Klux Klan.

What unites all these stories is a belief that the modern world, despite a surfeit of obfuscation, complication, and downright deceit, is not impenetrable, is not unknowable, and -- if the right questions are asked -- is even more intriguing than we think. All it takes is a new way of looking. Steven Levitt, through devilishly clever and clear-eyed thinking, shows how to see through all the clutter.

Freakonomics establishes this unconventional premise: If morality represents how we would like the world to work, then economics represents how it actually does work. It is true that readers of this book will be armed with enough riddles and stories to last a thousand cocktail parties. But Freakonomics can provide more than that. It will literally redefine the way we view the modern world.

(front flap)

Rich Dad's Guide to Investing is a roadmap for those who want to become successful investors and invest in the types of assets that the rich do. Whether your goal is to become financially secure, comfortable, or rich this book is your guide to understanding the asset classes and investment strategy.

Robert explains his basic rules of investing, how to reduce your risk and Rich Dad's 10 Investor Controls as well as ways to convert your earned income into passive portfolio income.

Rich Dad Poor Dad is Robert's story of growing up with two dads his real father and the father of his best friend, his rich dad and the ways in which both men shaped his thoughts about money and investing. The book explodes the myth that you need to earn a high income to be rich and explains the difference between working for money and having your money work for you.

20 Years... 20/20 Hindsight

In the 20th Anniversary Edition of this classic, Robert offers an update on what we’ve seen over the past 20 years related to money, investing, and the global economy. Sidebars throughout the book will take readers fast forward” from 1997 to today as Robert assesses how the principles taught by his rich dad have stood the test of time.

In many ways, the messages of Rich Dad Poor Dad, messages that were criticized and challenged two decades ago, are more meaningful, relevant and important today than they were 20 years ago.

As always, readers can expect that Robert will be candid, insightful... and continue to rock more than a few boats in his retrospective.

Will there be a few surprises? Count on it.

Rich Dad Poor Dad...

Explodes the myth that you need to earn a high income to become rich

Challenges the belief that your house is an asset

Shows parents why they can't rely on the school system to teach their kids

about money

Defines once and for all an asset and a liability

Teaches you what to teach your kids about money for their future financial

success

Rich Dad Poor Dad is Robert's story of growing up with two dads his real father and the father of his best friend, his rich dad and the ways in which both men shaped his thoughts about money and investing. The book explodes the myth that you need to earn a high income to be rich and explains the difference between working for money and having your money work for you.

Is the financial plan of mediocrity-a dream-stealing, soul-sucking dogma known as The Slowlane-your plan for creating wealth? You know how it goes-go to school, get a good job, save 10 percent of your paycheck, buy a used car, cancel the movie channels, quit drinking expensive Starbucks mocha lattes, save and penny-pinch your life away, trust your life-savings to the stock market, and one day you can retire rich. The mainstream financial gurus have sold you blindly down the river.

For those who don't want a lifetime subscription to "settle for less," and a slight chance of elderly riches, there is an expressway to extraordinary wealth that can burn a trail to financial independence faster than any road out there.

Demand the Fastlane, an alternative road to wealth that actually ignites dreams and creates millionaires young, not old. Hit the Fastlane, crack the code to wealth, and find out how to live rich for a lifetime.

19’900

СагслахGetting rich is not just about luck; Happiness is not just a trait we are born with.

These aspirations may seem out of reach, but building wealth and being happy are skills we can learn. So what are these skills, and how do we learn them? What are the principles that should guide our efforts? What does progress really look like?

Naval Ravikant is an entrepreneur, philosopher, and investor who has captivated the world with his principles for building wealth and creating long-term happiness. The Almanack of Naval Ravikant is a collection of Naval’s wisdom and experience from the last ten years, shared as a curation of his most insightful interviews and poignant reflections.

This isn’t a how-to book, or a step-by-step gimmick. Instead, through Naval’s own words, you will learn how to walk your own unique path toward a happier, wealthier life.

17’900

Дууссан(Дууссан)

The Richest Man in Babylon is an early twentieth century classic about financial investment and monetary success. Through a series of enlightening parables set in the heart of ancient Babylon, Clason provided his readers with economic tips and tools for financial success.

Here his text is interpreted for today and offers you 52 simple, powerful and proven techniques to manage your finances.

16’900

ДууссанЗахиалга хүргэх

Таны захиалга баталгаажсаны дараа бид 1-2 хоногийн дотор хүргэнэ.

Төлбөрийн нөхцөл

Төлбөрийг бүрэн шилжүүлснээр захиалга баталгаажна. Та гүйлгээний утга дээр захиалгын код, утасны дугаараа бичээрэй.

Хүргэлтийн нөхцөл

79’900₮-с дээш захиалгад хүргэлт үнэгүй, харин 79’900₮-с доош худалдан авалтанд хүргэлтийн төлбөр 5’000₮ нэмэгдэнэ.